Introducing the Hackworth Series Strategy Engine

Hackworth is AlphaNet’s latest SOTA (state of the art) multi-alpha engine that serves as both a series of strategies that delivers superior risk-adjusted returns as well as a proprietary framework that trains, computes, and evaluates new strategies and sources of alpha continuously in a scalable manner. In other words, new strategies for a variety of trading pairs will be born every week through Hackworth.

All strategies from the Hackworth Series will combine and hedge a multitude of low-correlation alpha sources (up to 20 distinct alphas per strategy) into one main strategy. All strategies within the Hackworth series will have a Sharpe of 2.5 or above.

Technology Overview

Hackworth is optimized on top of existing AlphaNet technology, and is model-agnostic (uses a combination of Transformer, LSTM, GRU, and CNN based models), market adaptive, and online-trained in real-time on the latest market data. It follows all the standard AlphaNet strategy pipeline protocols with certain variations optimized for efficiency.

For more details, basic outline of AlphaNet pipeline and system design is described in the Technical Whitepaper: https://alphanet-wp.phoenix.global/#iii.-structural-overview-of-alphanet-system-design.

Usage and Availability

Once any strategy from the Hackworth Series is vetted and approved, it will be available on AlphaNet AI DEX to all whitelisted users, at a per-user max quota based on the specific strategy, trading pair, and user tier.

Once deployed, order execution will automatically utilize our proprietary AI-powered algo execution for minimal slippage and costs. Strategies can be started and stopped at any time - the user is able to control his/her strategy portfolio based on discretionary preferences and understanding of market conditions.

All strategies will have a max total global quota in which when past specific total size across all users, it will be closed to any further allocation.

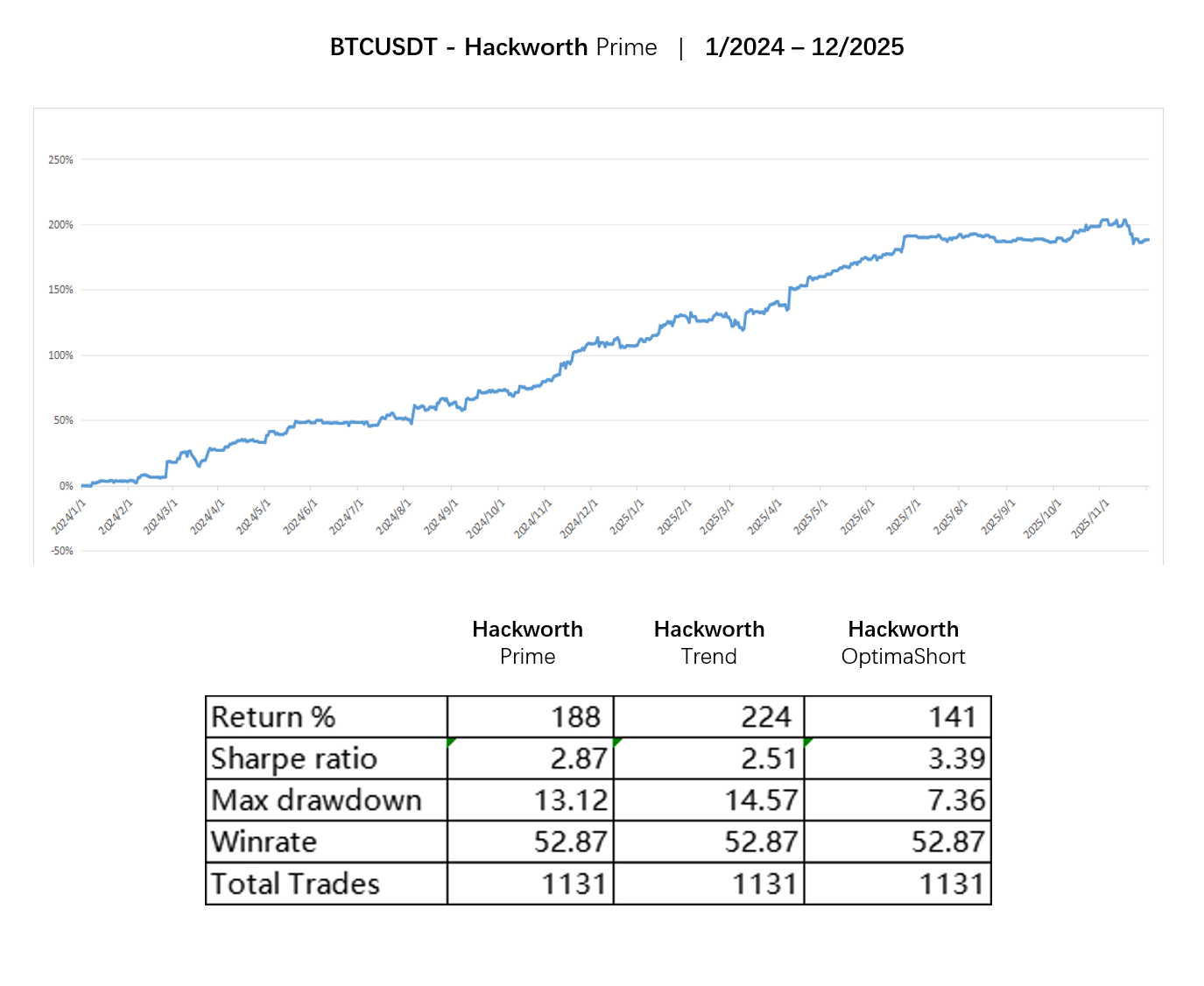

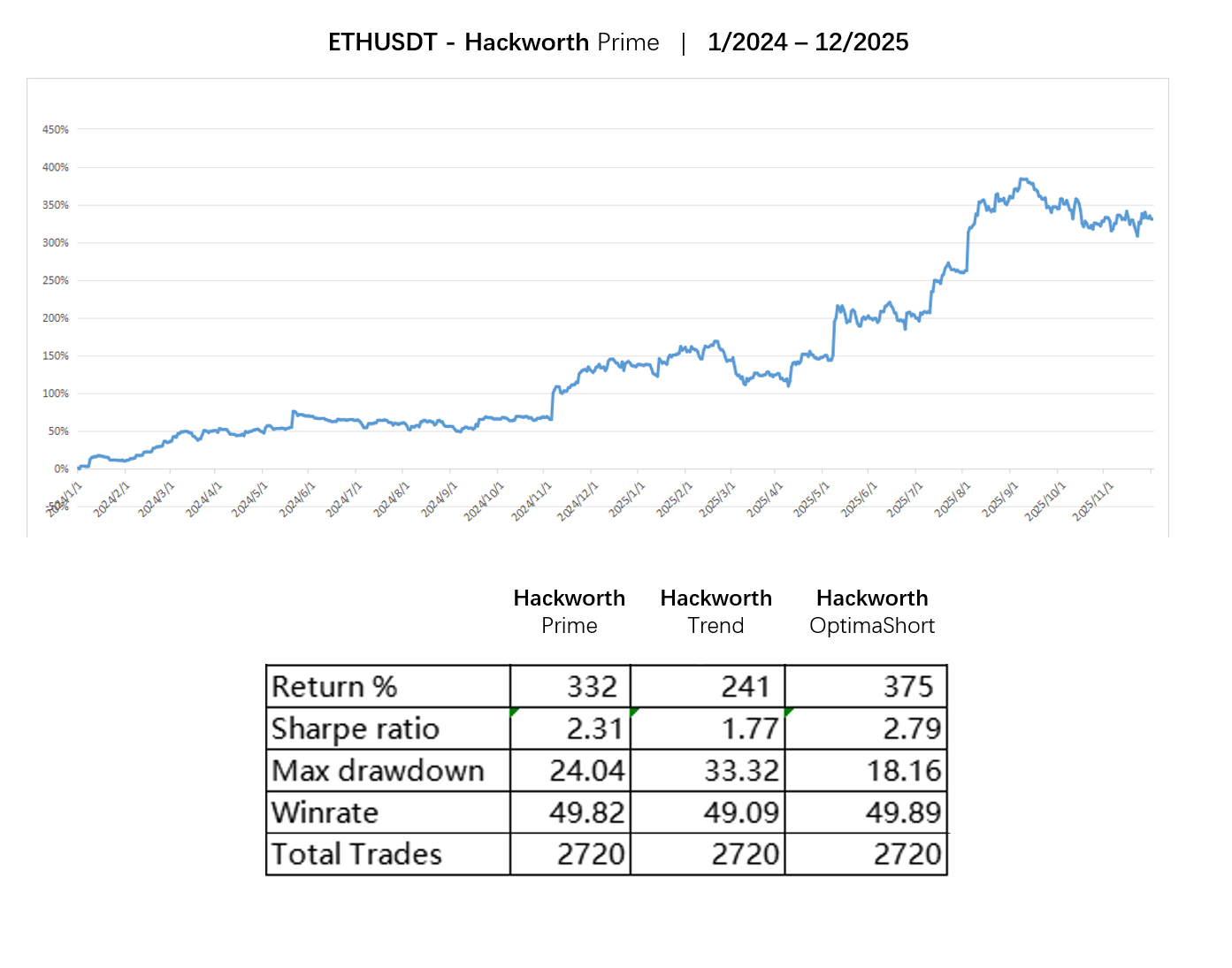

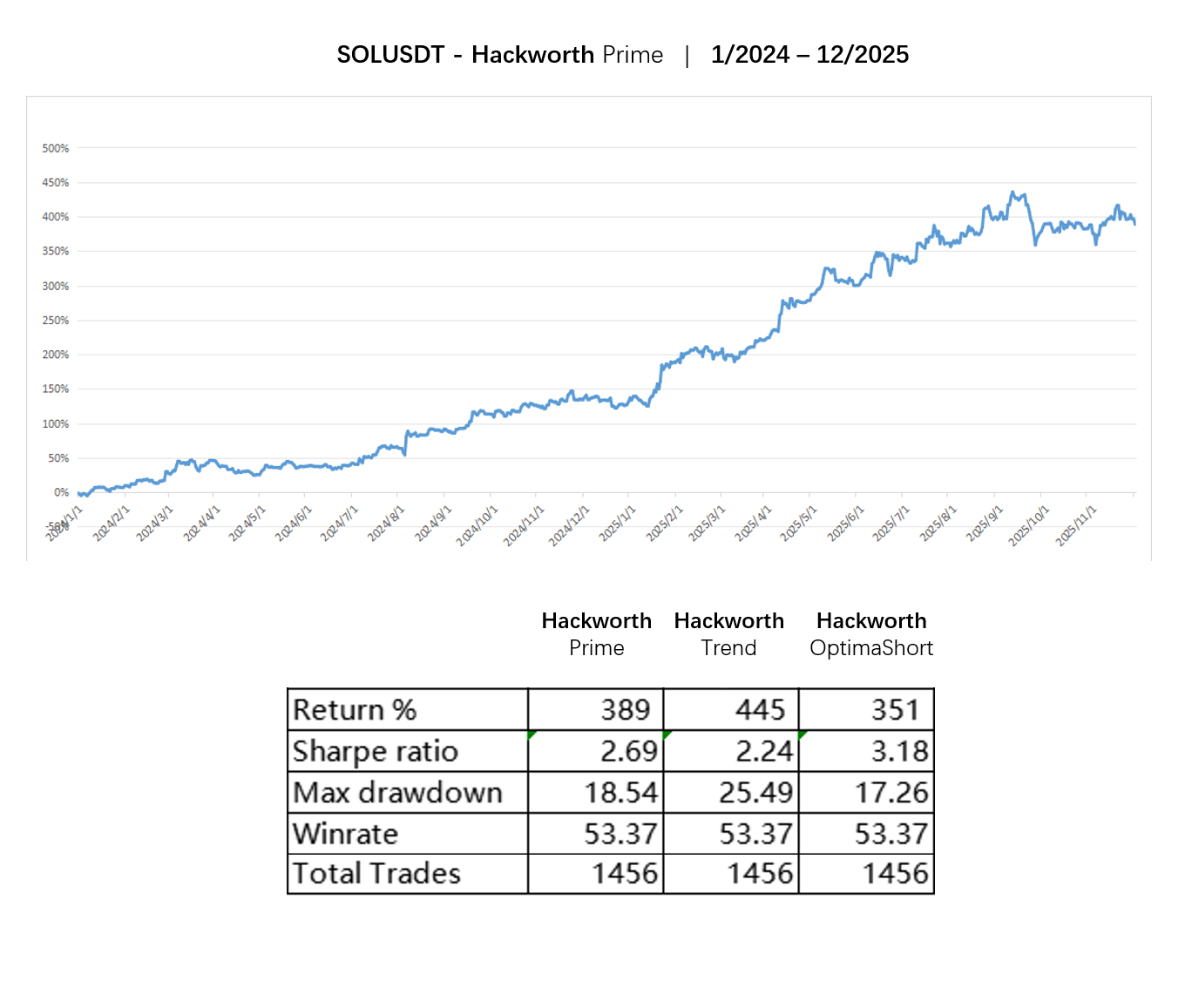

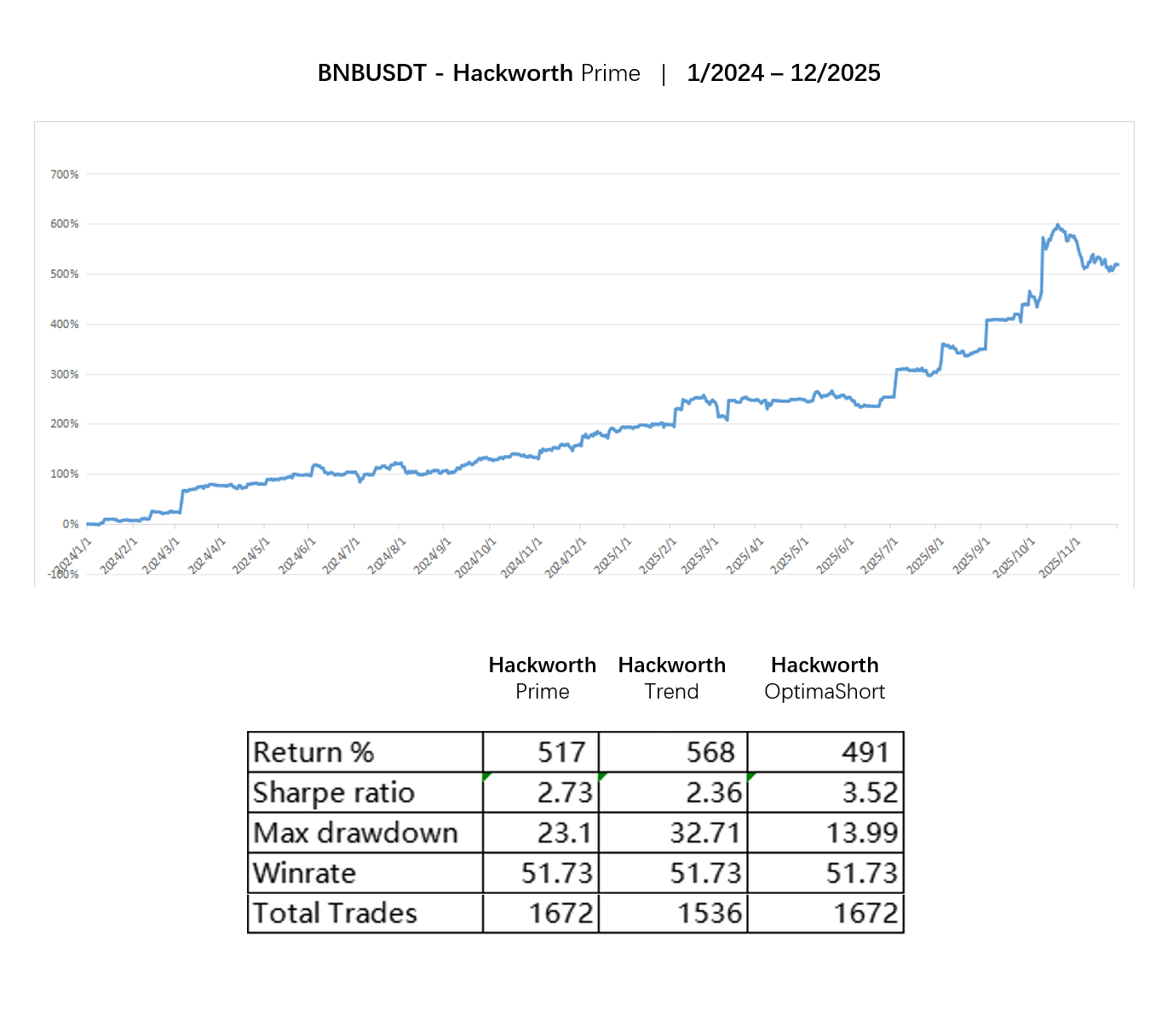

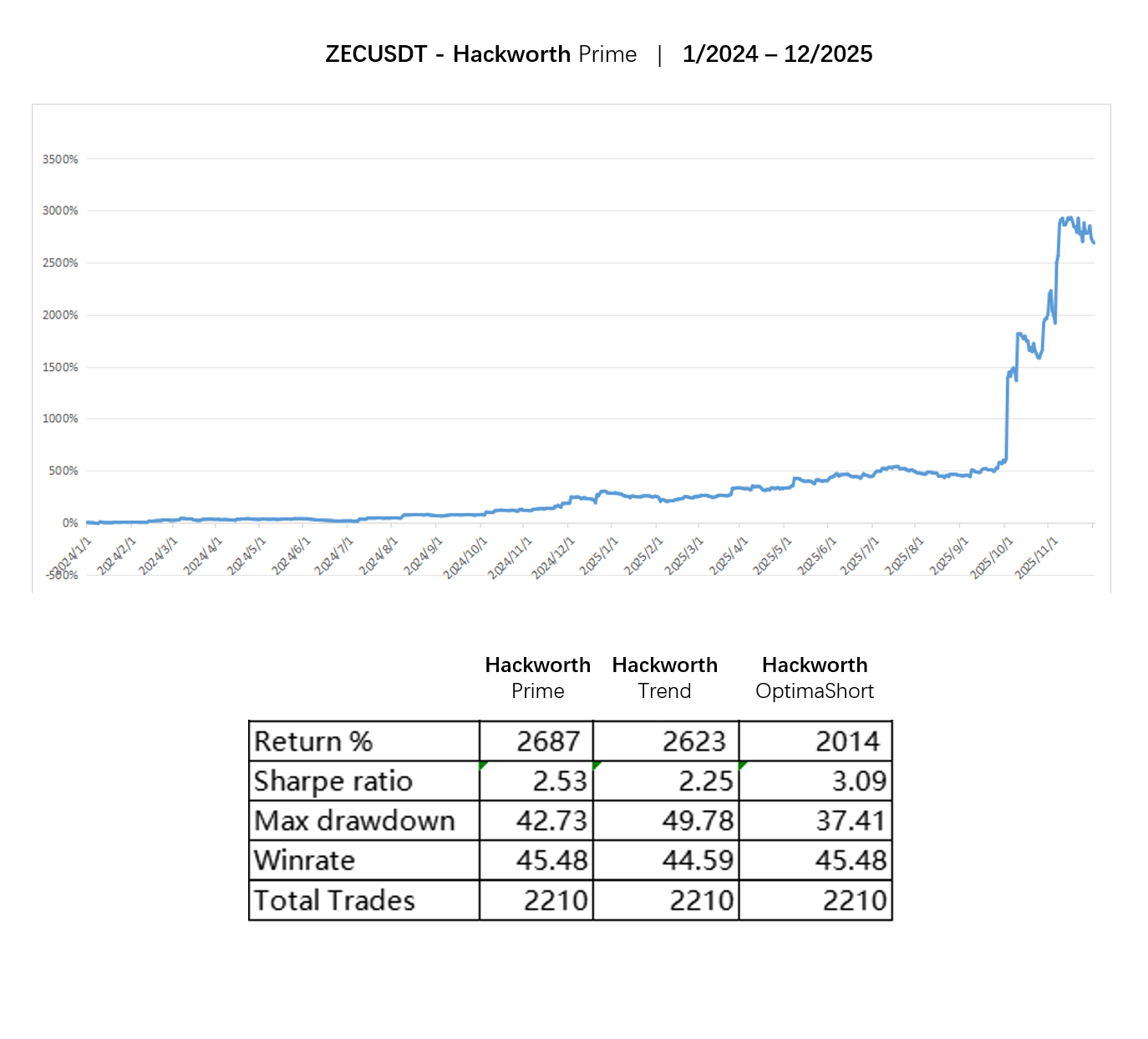

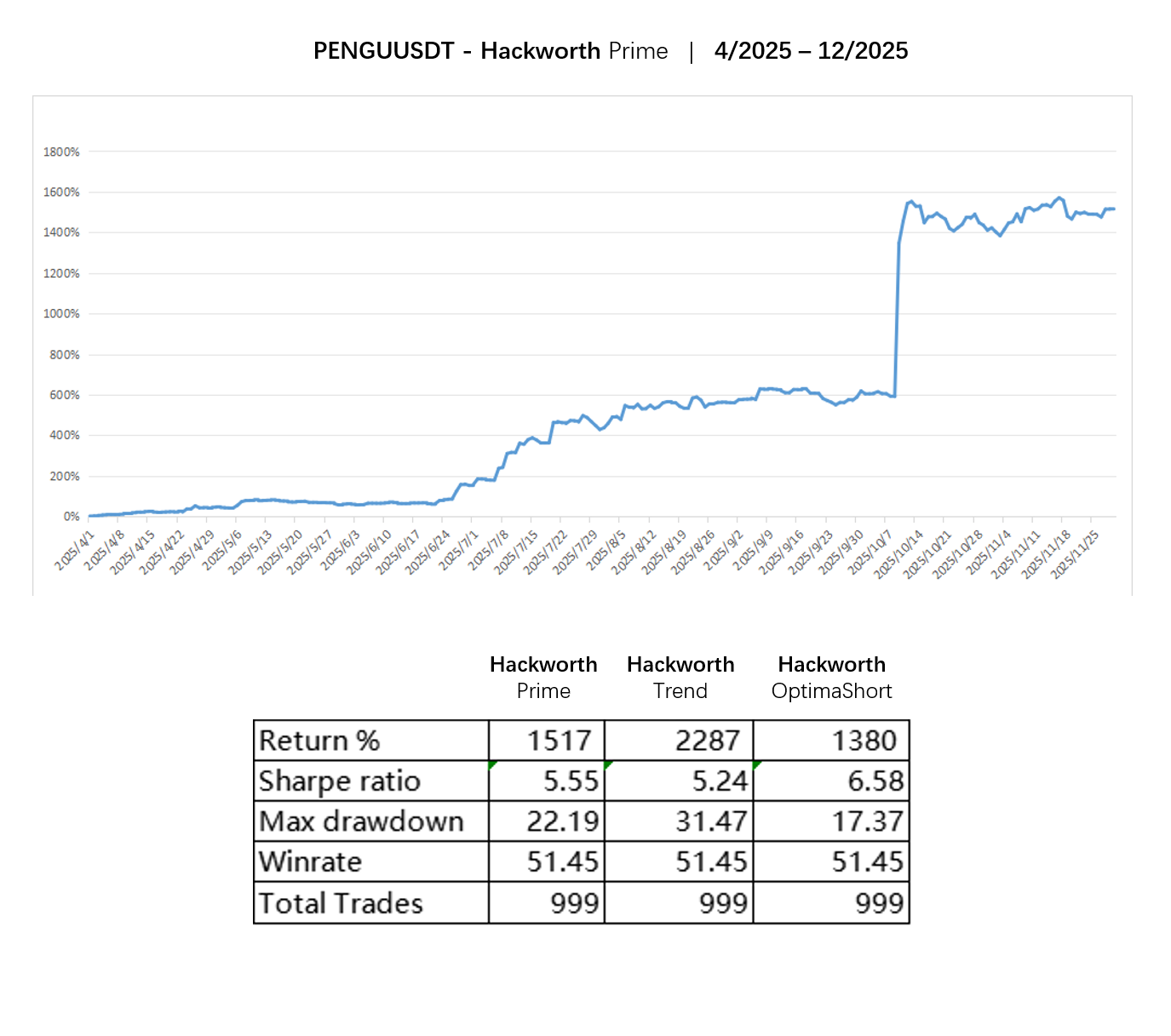

Performance and Stats (Selected Strategies)

Below are the latest performance metrics from some of the strategies that will be available from the Hackworth Series upon AlphaNet launch. Note that there are different versions that are optimized for different types of market regimes. The user is able to freely switch between different versions to optimize total PnL across different market environments.

The different versions of the strategy perform dynamic position-sizing differently and allocate differently to depending on the “profile” of the alphas:

Hackworth Prime – the most balanced version of the strategy designed to weather all market conditions, low average directional exposure (25%) and relatively balanced across all alphas, while being able to capture most heavy fat-tails.

Hackworth Trend – the long directional-bias, fat-tail heavy version of the strategy. In uptrends will deliver the maximum returns, while still has reduced but sizable exposure to short-bias and bearish alphas.

Hackworth OptimaShort – the variation of the strategy that is heavier on mean-reversion and shorting, and is the most risk-averse version of the Hackworth Series. Likely to deliver lower returns but smaller maximum drawdown.

Real-time live metrics for specific strategies will be live on AlphaNet and Strategy Arena post-launch.

Footnotes:

- Performance data timeframe noted in header, newer pairs on mainstream exchanges have a smaller timeframe, where default timeframe is from 01/2024.

- All performance data utilize 3bps buy and sell as exchange fee benchmark

- Trades are in small increments, and never use maximum allocated capital. Maximum directional exposure is 100% of all allocated capital in one direction, but occurs seldomly. This is with the exception of Hackworth Trend, which uses maximum exposure of 140 (1.4x leverage). Average directional exposure at any point in time across all strategies is anywhere from 20-30%.

- Any incremental buy and sell is attributed to a particular alpha signal – the winrate calculation is attributed to the profitability of that particular action.